Hard fork of USD

Now, let's pause for ten seconds to think: Could the US dollar and the dollar-backed global economy forever ignore productivity growth constraints and grow along with debt breakthroughs and geopolitical conflicts?

"The Times 03/Jan/2009 Chancellor on brink of second bailout for banks."

Credit money has the Matthew Effect. Economic globalization has boosted network externalities and enabled people to vote on the prospects of economies through currency holdings, thus further promoting differences between them. This exacerbates the impact on the whole when the core credit money goes wrong.

Meanwhile, the stability of credit money depends on people's expectations of the global economic environment and economic development prospects, and their confidence in the money issuers, which are driven by the vast and fragile network of trust and the river of demand built upon it.

The market competition for credit money reflects people's consensus and opinions on different issuers, which is why exchange rates exist. There is no substantial difference between the global credit monetary network composed of different sovereign countries and the members of the Federal Reserve, and even a lack of the most basic interest community basis. Therefore, we can foresee that when the balance is broken, the dazzling mercury will spread throughout the time and suffocate everyone at a fast speed.

In a centralized world, we could only hope that the large system can treat the minting of money more cautiously, and eventually choose the less bad one of the bad choices. This is because our trust relies on the most primitive interactions and it is difficult to form an effective consensus.

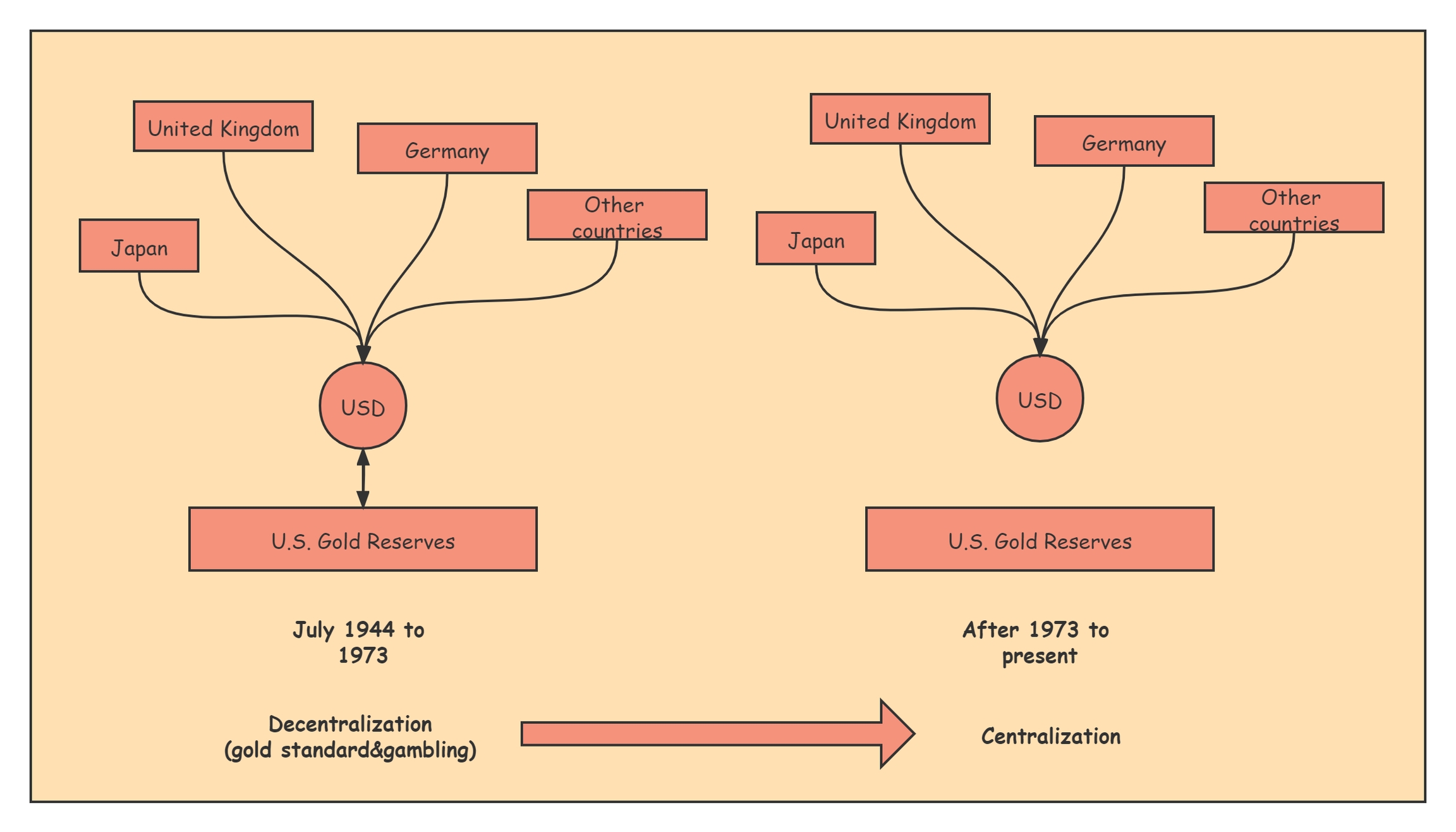

But with mathematics, encryption algorithms and blockchain, we can make a hard fork of the USD network happen.

Last updated